(Bloomberg) — PT Amman Mineral Internasional, the owner of the second-largest gold and copper mine in Indonesia, raised about 10.73 trillion rupiah ($715 million) in an upsized initial public offering, according to people familiar with the matter.

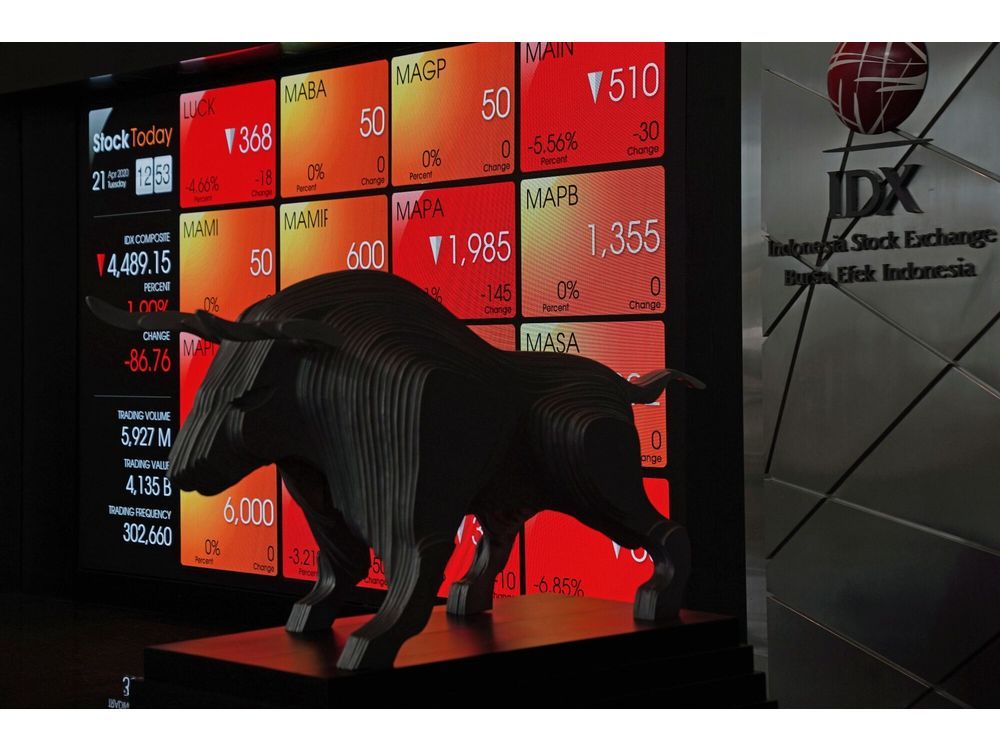

Amman Mineral sold 6.33 billion shares at a fixed price of 1,695 rupiah each, the people said, asking not to be identified as the information isn’t public. The company had set the size of the base offering at 6.29 billion shares, according to a term sheet seen earlier by Bloomberg News. The first day of trading on the Jakarta Stock Exchange is scheduled for July 5.

A representative for Amman Mineral didn’t immediately respond to requests for comment.

The IPO is the largest in Asia this year outside mainland China, according to data compiled by Bloomberg. First-time share sales in Southeast Asia’s largest economy have raised $2.2 billion since the start of January, a 77% increase from the same period last year. The surge contrasts with a slump in regional hubs such as Hong Kong and Singapore.

Listings from the renewable energy sector, metal and mining and related to the electric vehicle supply chain have attracted demand for new shares from domestic and foreign investors. The Jakarta-based miner’s debut is lined up to be Indonesia’s largest since GoTo Group in April 2022.

Amman Mineral owns the second-largest copper and gold mine in Indonesia and the fifth-largest copper mine in the world, when combined with deposits in its planned Elang project, according to data by Wood Mackenzie in the offering’s prospectus. The company posted net income of $1.09 billion in 2022, more than a three fold increase from the previous year’s figure.

The firm has one of the lowest cash costs among mines in the world, Aequitas Research analysts including Ethan Aw and Sumeet Singh wrote in a note prior to the pricing. Profitability has grown “dramatically” due to growth in copper and gold sales volumes, they said.

“However, copper prices might possibly be on a downtrend in the near term, which would affect the company’s prospects given that it doesn’t intend to undertake any hedging policies,” the analysts said.

Proceeds from the offering will be used for working capital, debt repayment and to fund refinery projects in West Nusa Tenggara province, according to the prospectus. The underwriters are BNI Sekuritas, CLSA Sekuritas Indonesia, DBS Vickers Sekuritas Indonesia and Mandiri Sekuritas.

—With assistance from Fathiya Dahrul.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door

Most Popular Metal Alloys for Industrial Applications

5 Errors To Avoid in Your Pharmaceutical Clinical Trial

Ways You Can Make Your Mining Operation Cleaner

Tips for Starting a New Part of Your Life

Easy Ways To Beautify Your Home’s Exterior

Tips for Staying Competitive in the Manufacturing Industry