Article content

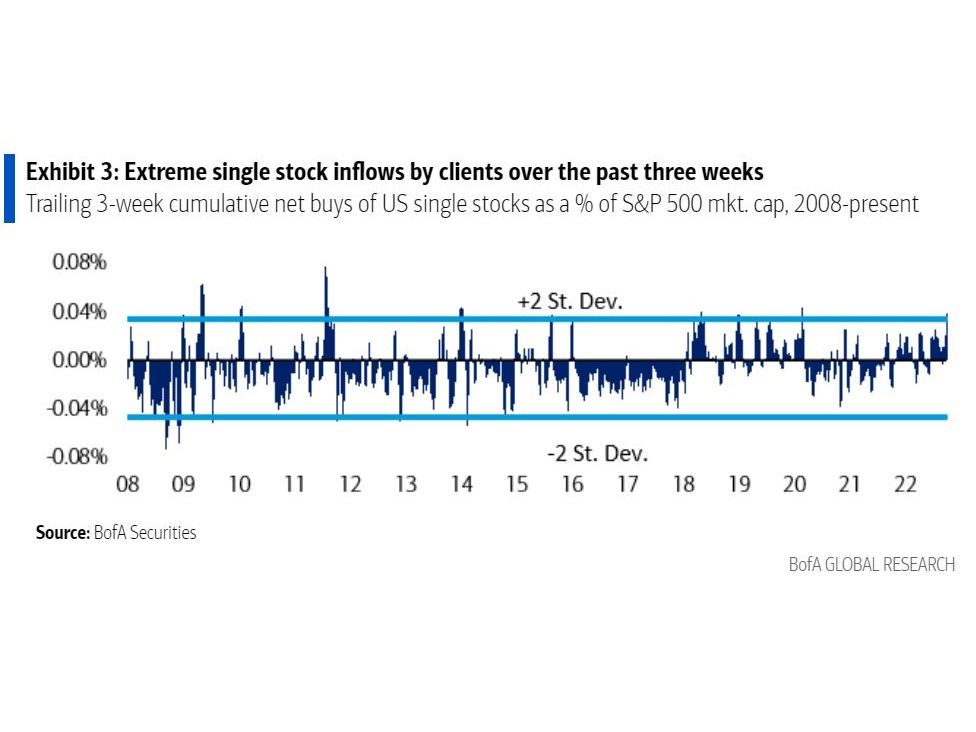

(Bloomberg) — Bank of America Corp.’s clients poured money into US equities for the sixth consecutive week led by hedge funds and private clients, with the intake by single stocks nearing historic extremes.

(Bloomberg) — Bank of America Corp.’s clients poured money into US equities for the sixth consecutive week led by hedge funds and private clients, with the intake by single stocks nearing historic extremes.

![uexo{ddjt7640n99f]lnkrf(_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2022/10/no-title-provided-11.jpg?quality=90&strip=all&w=288&h=216)

(Bloomberg) — Bank of America Corp.’s clients poured money into US equities for the sixth consecutive week led by hedge funds and private clients, with the intake by single stocks nearing historic extremes.

In the past three weeks, inflows into single stocks as a percentage of the S&P 500 Index’s market capitalization were in the 99th percentile of history since 2008, according to BofA strategists led by Jill Carey Hall. Prior extremes like this were followed by above average returns for the equity gauge over the subsequent months and one year later, they said.

Read: Earnings Flops Are Getting Penalized by the Most Ever, BofA Says

Still, “most prior instances of extreme inflows following the global financial crisis typically were preceded by extreme outflows in the several months prior,” Carey Hall wrote in a note to clients Tuesday. But that’s “not the case this time,” since cumulative inflows this year in US dollars have been the most positive in BofA’s data history, she added.

Last week, buying was led by BofA’s hedge fund clients. Private clients also snapped up equities for the fourth straight week, while institutional clients sold stocks after buying for two weeks.

Overall, clients bought stocks across seven of the S&P 500’s 11 sectors, led by technology, health care and communication services while financial and energy stocks saw the biggest outflows. They have been large net buyers of tech, media and telecom stocks at a time when flows were down for consumer discretionary shares.

Value stocks, in particular, could be poised for a bounce. In a separate note Tuesday, BofA strategists led by Savita Subramanian said value funds may benefit from seasonality since 43% of those funds historically outperform their benchmark from November to January.

“Hedge funds, which have been reducing their cyclical exposure most of the year, are now overweight defensives relative to cyclicals first time since Oct. 2021,” Subramanian wrote in a note to clients. The shift was primarily driven by hedge funds’ reduced exposure to materials, industrials and energy, she said.

Read more: BofA Sees Year-End Rally for Loser Stocks on Tax-Loss Harvesting

Long-only mutual funds, however, appear to be expecting a soft landing for the US economy and have maintained their pro-cyclical view, with overweights in discretionary and industrials and a sizeable underweight in consumer staples.

In years when the market was down through October, the dominance of value funds was even more pronounced, with 45% outperforming compared with 38% of core funds and 40% of growth funds, according to the bank. “This may be likely this year given the depth and breadth of the market decline,” Subramanian said.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door