Article content

(Bloomberg) — Stock-market investors are hoping for a strong finish to a chaotic year.

Stock-market investors are hoping for a strong finish to a chaotic year.

(Bloomberg) — Stock-market investors are hoping for a strong finish to a chaotic year.

A less hawkish Federal Reserve and encouraging inflation data could unleash a mega-rally in December, which has proved to be a strong month for the stock market over the past 70 years. This year, though, it may get off to a late start: With all the twists and turns heading into 2023, even bulls may sit on the sidelines until the release of the next key inflation report on Dec. 13.

Fed Chair Jerome Powell provided some optimism on Wednesday by signaling that the central bank will slow the pace of interest-rate increases. Following his comments, the S&P 500 Index rallied 3.1% to leap over its 200-day moving average — a widely watched technical indicator used to gauge longer-term price trends — for the first time since April. That helped the benchmark end the week up 1.1% as traders assess a surprisingly strong jobs report and the overarching risk of rate hikes pushing the US economy into a recession.

“The stock market has probably seen the lows because we’re likely near the end of the Fed’s rate hikes,” said Eric Beiley, executive managing director of wealth management at Steward Partners Global Advisory. “As I look to next year, I do see the Fed’s policy of raising rates coming to an end, hopefully early in 2023, because these hikes are having an impact in weakening inflation numbers and a slowdown in the global economy.”

The potentially strong finish for equities will cap a bruising year of volatility, as the Fed’s realization that inflation wasn’t temporary put an end to the shortest bull market on record. Stocks then plunged into a bear market as the central bank hiked rates to tame decades-high inflation, only to rebound in October when inflation started to cool. That’s left the S&P 500 down less than 15% for 2022.

This tug-of-war between bulls and bears will continue over the next eight trading sessions as the Fed enters its quiet period before its final meeting of 2022, which takes place a day after the latest consumer price index is released on Dec. 13. Few economic announcements have mattered more this year than November’s inflation reading, given the Fed’s aggressive campaign to tamp down soaring prices.

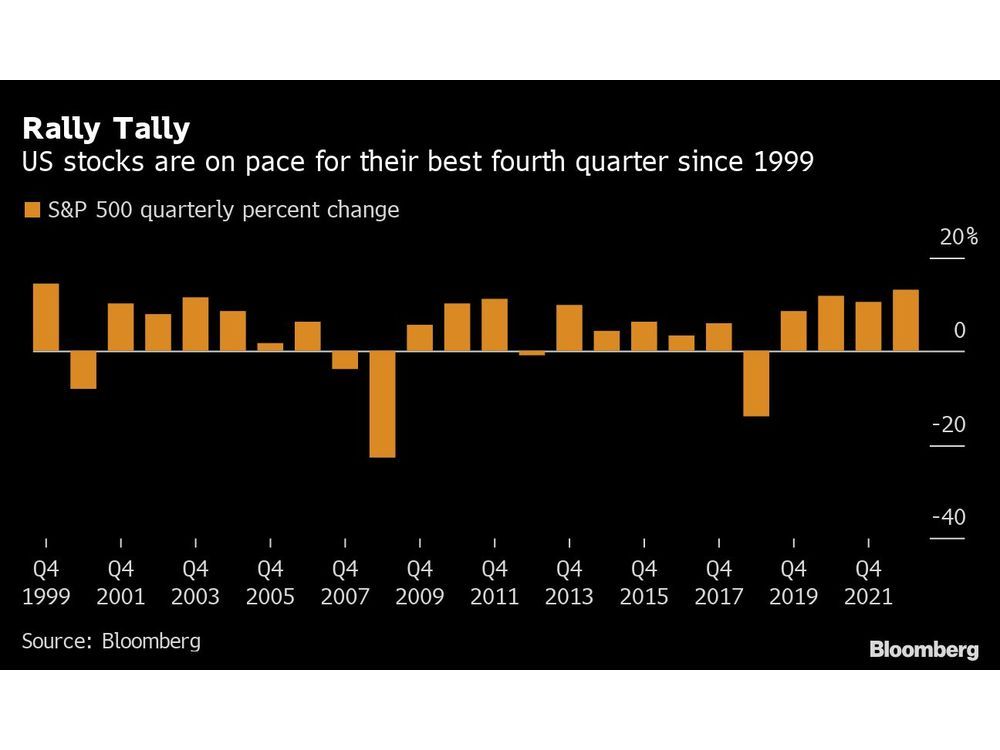

If the market rebound since mid-October holds through December, the S&P 500 would end an otherwise tumultuous year for global money managers on a high note. The S&P 500 is up 14% since the end of September and on pace for its best fourth quarter since 1999.

The stock market is forward looking, with equities discounting what’s going to happen at least six-to-12 months from now. History suggests US stocks climb once elevated inflation peaks, with the S&P 500 delivering double-digit gains one year later. That optimism has helped juice the latest rally.

It has also made bulls encouraged that US share prices are poised for strong gains into the end of the year, as cooling housing markets, gasoline prices, private payrolls and job openings have stoked a debate on whether equities have bottomed. And volatility has eased significantly, with the Cboe Volatility Index, or VIX, falling below 20 last week after spiking as high as 34.53 intraday on Oct. 12.

Even so, stocks still face more obstacles as investors wait to see if the index’s January downtrend will be broken.

Mimi Duff, managing director at GenTrust, doesn’t think the S&P 500 has priced in a shallow recession yet. Her base case is for the benchmark index to fall to 3,300, a 19% drop from Friday’s close. But that hasn’t stopped her from finding buying opportunities. Duff is recommending clients snap up shares of large-cap biotech companies due to their strong balance sheets and is also growing more optimistic on small caps due to their cheaper valuations.

“No one wants to be catching a falling knife, but we don’t want to miss out,” said Duff, who thinks inflation has likely peaked and could fall to 3% to 4% in the next year. “It’s not easy to land a plane on a narrow pathway,” she added, referring to the likelihood of a mild economic downturn, “but we should all be more optimistic because the inflation trends have improved.”

So, what could trigger the S&P 500 to fall to new lows? A hawkish Fed that remains steadfast on jumbo-sized rate hikes, according to Beiley from Steward Partners.

For now, he is advising clients to stick with shares of consumer staples, energy and financials. But if the economy gradually slows down next year and avoids a recession, he’s betting that Big Tech stocks, including Amazon.com Inc., will benefit from a better profit scenario.

“The unknown is the magnitude of the economic slowdown,” Beiley said. “Is it a soft landing or a slower economic environment? If we get that, you have to be more optimistic on the equity market. But if it’s a more substantial slowdown with a recession, equities will likely drop further from here.”

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door