Some of the best swing trading opportunities come from more volatile stocks. You can always start with a reduced position size to help minimize the risk. Selling into strength is another tactic for reducing risk and that’s what helped us keep our CELH stock trade positive.

X

Celsius (CELH) was one of the rare stocks that saw an overall gain in 2022. The nearly 40% thrust wasn’t too shabby but it also followed a nearly 50% gain in 2021 and almost 1,000% gain in 2020. With distribution deals and growing popularity the energy-drink maker has given investors plenty to cheer about since its initial public offering (IPO) in 2017.

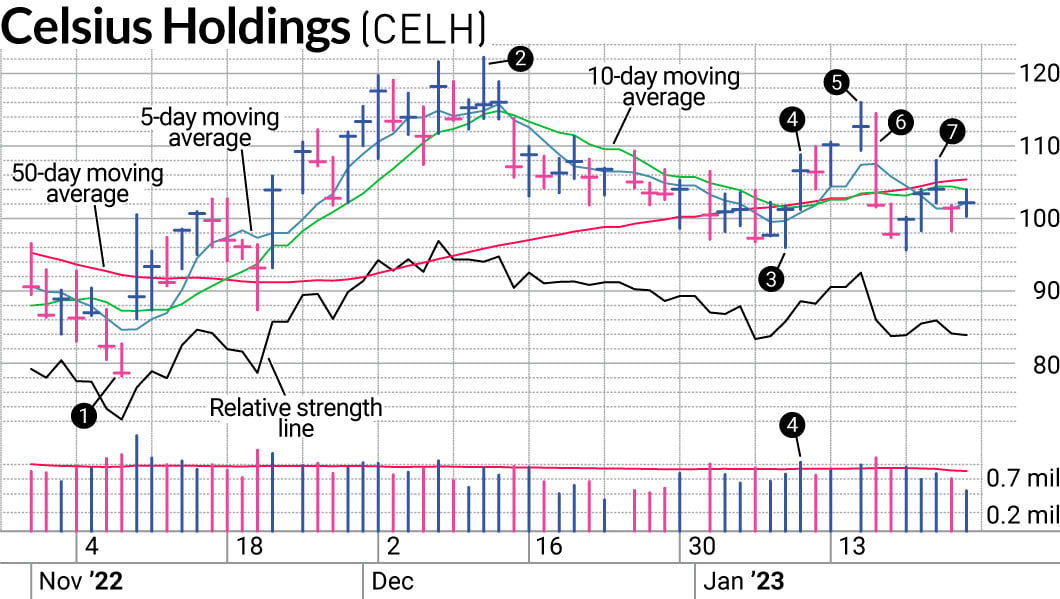

But the huge gains in CELH stock don’t come easy. That strong 2022 started with a 36% drop in the first month as part of a 65% correction off its November 2021 peak. Even the latter part of 2022 saw a 34% drop from its high at the low of its cup base (1). After a 56% climb from its lows to all-time highs in December (2), CELH stock kept proving that it was worth watching.

We saw a swing trading opportunity after CELH stock tacked on a handle to its cup with a 21% pullback off its peak. Even better, the low of that pullback showed a solid upside reversal with a close in the upper part of its range (3). This was immediately following CELH stock “hugging” its 50-day moving average line.

When CELH stock jumped forward after the upside reversal and broke its short-term downtrend, we added it to SwingTrader (4). The trading volume showed a nice confirmation of the price strength. However, the CELH stock trade did have a higher risk profile at 5% risk using the entry-day low. We felt that it needed the room due to its volatile character with a tendency to move nearly 6% intraday on average.

Once we had a 5% gain, we took profits on a third of the position (5). That by itself helped reduce the risk with a smaller position size. We also raised our stop from the entry-day low to our entry price. That way even if our profits evaporated, we still leave with a nearly 2% gain for the trade.

When stock market indexes got hit on Jan. 18, CELH stock suffered with them (6). But it fared even worse. Celsius was down nearly 10% at its 101.83 close. But we didn’t wait for it to get that bad. Rather we exited as 107.29 as it slashed through its 5-day moving average line. The end result was over a 2% gain for the trade.

Our focus on protecting profits was the right call in this case. A number of stocks that got caught in that pullback are already back at all-time highs. But CELH stock isn’t one of them. It got rejected from its 50-day moving average line this week (7). It may come back eventually to lead again, but for now its run out of energy.

Taking our 2% gain gave us a small victory but also allowed us to look for more “high-energy” opportunities as the market bounced from its two-day pullback.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on Twitter at @IBD_JNielsen.

YOU MAY ALSO LIKE:

What The Stock Trader’s Almanac Says About The Prospects For 2023

MarketSmith: Research, Charts, Data And Coaching All In One Place

Stock Market Forecast 2023: Challenges Abound For Dow Jones, But Stock Pickers Can Shine

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door