NEW YORK, New York – U.S. stocks rallied, and the dollar slumped on Tuesday, despite a CPI reading for January that was marginally higher than expected.

The greenback, however, later clawed back losses, while industrial stocks reversed course late in the day and finished flat to lower.

The Consumer Price Index (CPI) for All Urban Consumers in the United States increased by 0.5% on a seasonally adjusted basis last month, according to data from the U.S. Bureau of Labor Statistics. This followed an increase of 0.1% in December. Over the last 12 months, the all-items index increased 6.4% before seasonal adjustment, with the index for shelter contributing the most to the monthly increase. The food index also increased by 0.5%, while the energy index rose 2.0% due to an increase in all major energy component indexes.

The CPI for all items, less food, and energy, rose 0.4% in January, with categories such as shelter, motor vehicle insurance, recreation, apparel, and household furnishings and operations indexes contributing to the increase. Meanwhile, the indexes for used cars and trucks, medical care, and airline fares decreased over the month.

The all-items index increased 6.4% for the 12 months ending in January, which was the smallest increase since the period ending in October 2021. The all-items less food and energy index also rose 5.6% over the last 12 months, its smallest increase since December 2021. However, the energy index increased 8.7% for the 12 months ending in January, while the food index increased by 10.1% over the last year.

The data will be closely watched by investors and economists as they evaluate the state of the U.S. economy and the potential for inflation.

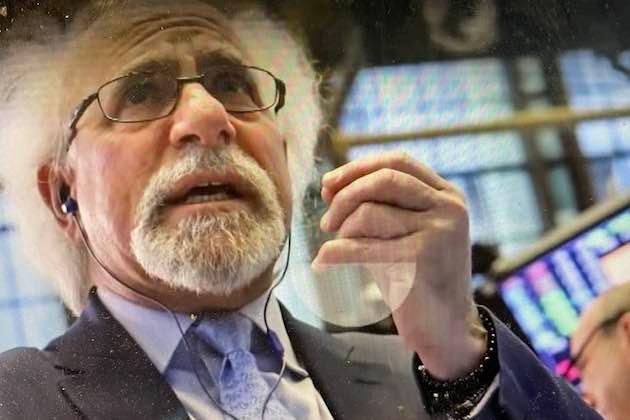

“I don’t think this report moves the needle for the Fed, and I suspect they’re taking a hard look at the data. Does it mean we are headed for at least two more rate hikes? Absolutely. My guess is the year-over-year decline in topline and core CPI suggests another 25 basis point hike in March and another one in May,” Peter Cardillo, chief market economist at Spartan Capital Securities, New York, told Reuters Tuesday.

“The topline and core were higher than consensus, but year-over-year, both core and topline are still headed lower, just less than expected. It still indicates that overall inflation is moving down,” Cardillo said.

The Nasdaq Composite gained 68.36 points or 0.57 percent to close Tuesday at 11,960.15.

The Dow Jones industrials slid 156.66 points or 0.46 percent to 34,089.27.

The Standard and Poor’s 500 inched down 1.16 points or 0.03 percent to 4,136.13.

On Tuesday’s currency market close, the U.S. dollar made gains against the Japanese yen, with the USD/JPY pair up 0.51 percent to 133.04. The euro slipped to 1.0737.

The U.S. dollar saw marginal gains against the Canadian dollar, with the USD/CAD pair up 0.06 percent to 1.3349. Meanwhile, the British pound lost ground against the greenback, with the GBP/USD pair down 0.32 percent to1.21740.

The Swiss franc eased to 0.92160. The Australian dollar was a fraction weaker at 0.6989. The New Zealand dollar slid 0.20% to 0.6339.

On Tuesday, major stock indices around the world closed mixed with slight movements in either direction.

In Europe, the ESTX 50 PR.EUR index declined by 0.06 percent, closing at 4,238.76, and the Euronext 100 Index fell by 0.03 percent, ending the day at 1,354.57. Belgium’s BEL 20 Index also declined by 0.10 percent, closing at 3,892.94.

The German Dax ended the day at 15,380.56, down 0.11 percent, while France’s CAC 40 gained 0.07 percent to close at 7,213.81.

In Asia, the Nikkei 225 in Japan climbed 0.64 percent to close at 27,602.77, and South Korea’s KOSPI Composite Index rose 0.53 percent to finish at 2,465.64.

The Hang Seng in Hong Kong fell 0.24 percent to close at 21,113.76, while China’s SSE Composite Index increased by 0.28 percent to end the day at 3,293.28. The Shenzhen Index in China declined by 0.15 percent to close at 12,094.94.

India’s S&P BSE SENSEX Index increased by 0.99 percent, closing at 61,032.26, and the FTSE Bursa Malaysia KLCI in Malaysia increased by 0.60 percent, ending the day at 1,483.97.

New Zealand’s S&P/NZX 50 and Indonesia’s IDX Composite Index also closed with slight movements, while Australia’s S&P/ASX 200 and Singapore’s STI Index both declined by 0.20 percent.

In other parts of the world, the Top 40 USD Net TRI Index in South Africa closed 0.30 percent lower at 4,429.31, while Russia’s MOEX Russia Index declined by 0.19 percent to close at 2,222.51.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door