Article content

(Bloomberg) — The historic market meltdown of Adani Group has shown signs of abating after the Indian conglomerate went on a tour to restore confidence and won a $1.9 billion investment by a boutique firm.

The historic market meltdown of Adani Group has shown signs of abating after the Indian conglomerate went on a tour to restore confidence and won a $1.9 billion investment by a boutique firm.

(Bloomberg) — The historic market meltdown of Adani Group has shown signs of abating after the Indian conglomerate went on a tour to restore confidence and won a $1.9 billion investment by a boutique firm.

But a closer look at billionaire Gautam Adani’s empire shows while fears of a debt blowup in the next three years have receded, investors still have doubts about the longer-term repayment abilities. The stock-market abyss that the ports-to-power conglomerate remains in and uncertainties over credit ratings continue to fan worries about its access to funds following a short seller attack.

Such concerns have lingered on even after the Adani Group renewed efforts to appease investors during a three-day roadshow this week in Singapore and Hong Kong, where executives said the conglomerate has enough money to repay debt due over the next three years. A family trust also sold 154.5 billion rupees ($1.9 billion) of stock in four companies to GQG Partners, a US-based boutique firm.

“It’s certainly positive he’s managing to sell some of his holdings and raise some cash,” said Kamil Dimmich of North of South Capital. “If we can see that engine resume where he can access financial markets again, that could stabilize things,” he said, referring to the billionaire.

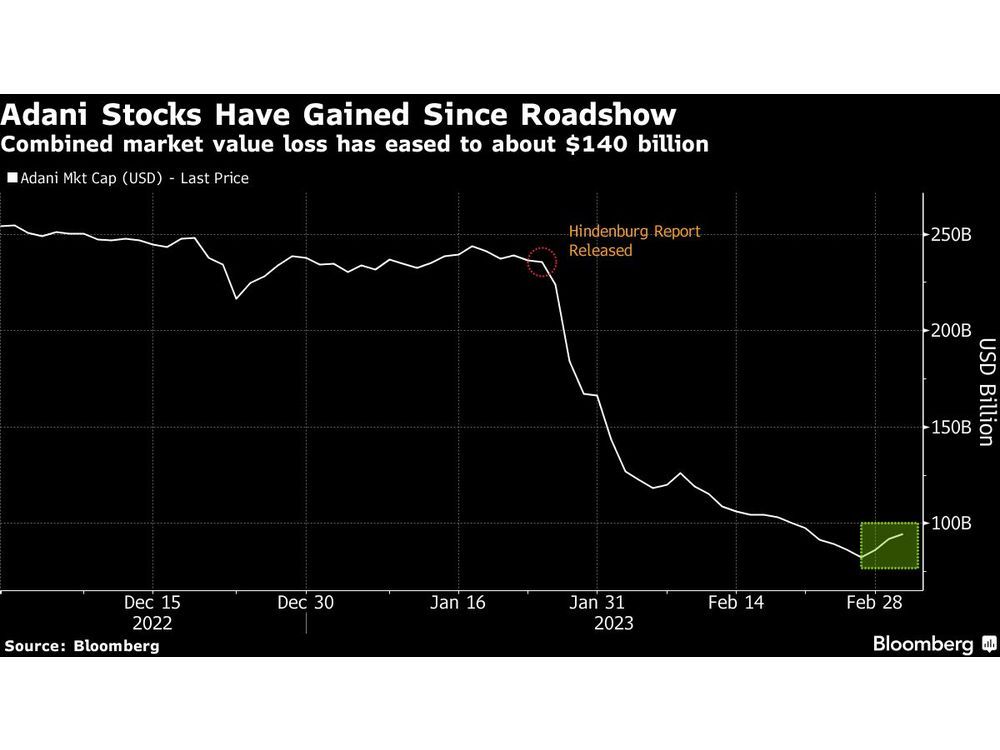

The Adani Group has also cut expenses and made early debt repayment to alleviate a rout that has erased $153 billion from its stocks since US-based Hindenburg Research’s fraud allegations, which it has denied. The following indicators will likely prove key to money managers’ decisions on the conglomerate, as its crisis of confidence continues to unfold.

Bond Risk

While most of Adani Group’s 15 dollar bonds are off their lows hit right after Hindenburg’s Jan. 24 report, all but one are still in the red.

The group’s four notes due by the end of 2026 are trading between 84 cents to 94 cents on the dollar, down from 91 cents to 99 cents before the report, but still indicating relatively low-payment risk.

It’s a different picture for bonds with maturities further down the road. Seven of the group’s 11 notes due in or after 2027 are trading below or near 70 cents on the dollar, a level that defines distress or severe concerns about timely payment.

China’s Mega Restructure; Trouble in India: Credit Edge Podcast

Stock Slump

After a rout that had erased almost two-thirds of their combined market value, the group’s 10 stocks staged a collective rebound Wednesday for the first time since Hindenburg’s report, led by a near 15% surge in flagship Adani Enterprises Ltd.

The latest gains have helped cut the conglomerate’s market wipeout to about $140 billion from a peak of $153 billion.

But, it’s still early days. Adani Total Gas Ltd., Adani Transmission Ltd. and Adani Green Energy Ltd., which racked up the biggest losses, remain 70% to 80% lower from their Jan. 24 levels. Hindenburg said in its report that Adani’s seven key namesake stocks had sky-high valuations and faced downside of 85%.

Shaky Ratings

Moody’s Investors Service, which cut its outlook for Adani Green and three other group firms to negative from stable last month, said that refinancing maturing debt, changes to capital-spending plans, and capital-raising efforts are key variables to watch.

Further ratings actions could follow if the firms’ ability to raise capital is significantly curtailed, there is a significant increase in borrowing costs or deterioration of fundamentals.

Similarly, S&P Global Ratings also downgraded the Adani Group’s outlook to negative in February. It said that Indian banks will likely charge higher risk premiums and become extra cautious in the aftermath of the crisis.

Investment Calls

Of the seven key companies, five have minuscule analyst coverage and even for the other two with more following, the brutal selloff appears to have made a limited impact on the brokerages’ perceptions.

Flagship Adani Enterprises., which is tracked by only two brokerages, is split between a buy and a hold recommendation, according to Bloomberg-compiled data. Adani Ports & Special Economic Zone Ltd., the crown jewel and a component of India’s benchmark NSE Nifty 50 Index, is the most followed and has in fact increased its tally of buy calls to 21 from 20 before the crisis.

“What is missing here, what nobody talked about, was these are phenomenal, irreplaceable assets,” Rajiv Jain, chairman of GQG said. “You have to be greedy when people are fearful.”

But some aren’t convinced. “Investors should still avoid these shares since they are highly volatile,” said Karthick Jonagadla, chief executive of Mumbai-based Quantace Research & Capital Pvt. “If any investor sold these shares a few weeks ago because of a whistleblower report and wants to buy now because they are cheap, such trades are mere speculation and lack fundamentals.”

ESG Retreat

The crisis also has spilled over into the ESG market, prompting the asset management unit of JPMorgan Chase & Co. to wipe its relevant portfolios clean of exposure to the Adani empire.

India’s top court said Thursday it has set up a panel to probe allegations against Adani Group. It also asked the local markets regulator to investigate any manipulation in the group’s stocks and inform about its findings within two months.

—With assistance from Ishika Mookerjee.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation