Article content

(Bloomberg) — Asian shares slumped Friday following a sharp decline on Wall Street amid concern that pockets of trouble in the US banking sector could portend broader dangers.

Asian shares slumped Friday following a sharp decline on Wall Street amid concern that pockets of trouble in the US banking sector could portend broader dangers.

![12inrzl]{6oi87]299e4{l4f_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/03/kuroda-decides-dollar-yen-waits-for-kurodas-final-boj-decis.jpg?quality=90&strip=all&w=288&h=216)

(Bloomberg) — Asian shares slumped Friday following a sharp decline on Wall Street amid concern that pockets of trouble in the US banking sector could portend broader dangers.

An Asian equity gauge slid more than 1%, dragged down by finance stocks after banks came under fire in the US following the collapse of Silvergate Capital Corp. MSCI China Index also fell and erased all of its gains for this year.

Silicon Valley-based lender SVB Financial Group was at the center of the storm Thursday, losing 60% after taking steps to shore up its capital position, stoking concern that soaring interest rates are eroding balance sheets.

Read more: Read more: Wall Street’s Favorite Trade Is Hammered in Bank Stock Meltdown

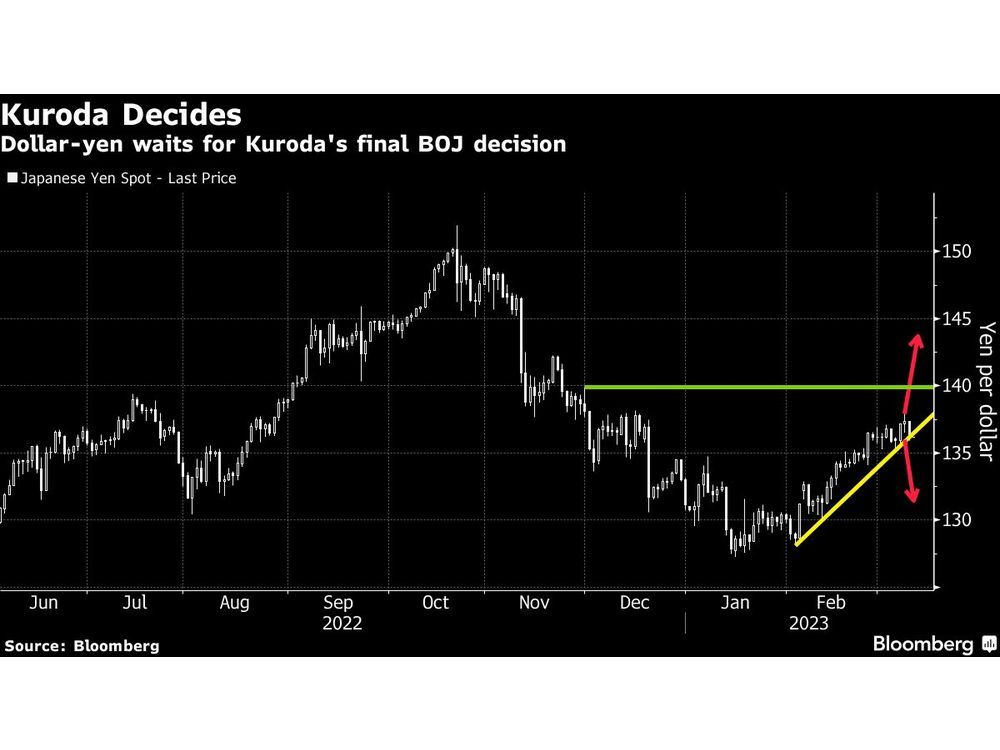

The yen rebounded after slipping during early trading on Friday. The currency gained the most in a month on Thursday on the back of the deteriorating risk sentiment and in the lead up to Bank of Japan Governor Haruhiko Kuroda’s final policy announcement.

The central bank is leaning toward monitoring the impact of recent tweaks to its stimulus program rather than making another adjustment, according to people familiar with the matter.

“We expect continued policy normalization and it is likely to come under the new Governor Ueda. The exact timing of the policy change will be difficult to predict and could be as early as the second quarter,” said Jennifer Kwan, senior investment specialist for global fixed income, currency and commodities at JPMorgan Asset Management. “We are staying underweight in Japanese bonds, in view of the potential higher yields in JGBs later this year.”

Treasury yields extended their declines after the rout in stocks spurred demand for haven assets. Australian and New Zealand government bonds rallied.

US stocks had gained early in the session Thursday after data showed weekly jobless claims had risen to 211,000 during the week ending March 4, ahead of expectations for 195,000 and marking the first time claims surpassed 200,000 since early January.

The numbers set the stage for Friday’s monthly jobs report, with even just slightly stronger-than-forecast figures expected to cement bets for a bigger hike at the March 21-22 Fed meeting. Economists project a 225,000 increase in February payrolls, about half January’s blockbuster pace, but a figure in that range would confirm the US economy continues to add jobs at a strong rate.

A softer-than expected number could soften wagers on a half-point move in March, and tilt expectations back to a quarter-point hike.

Cryptocurrencies dropped after pulling up slightly early on Friday. Bitcoin on Thursday fell 8.1%, the most since November, amid Silvergate’s meltdown.

In commodities, oil headed for the biggest weekly loss since early February as the prospects of higher interest rates weighed on energy demand outlook.

Key events this week:

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

—With assistance from Isabelle Lee, Peyton Forte and Vildana Hajric.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation