Article content

(Bloomberg) — After weeks of turbulence and giddying declines, the UK bond market may be about to get a breather.

After weeks of turbulence and giddying declines, the UK bond market may be about to get a breather.

(Bloomberg) — After weeks of turbulence and giddying declines, the UK bond market may be about to get a breather.

The calendar is free of market-moving data or central bank meetings until the next inflation update on July 19. That should provide traders with the lull they need to front-load gilt purchases before the primary market goes into summer hibernation in August, potentially putting the UK’s government bonds on track for a traditional July bounce.

“Until the next CPI data, we should be fine,” said Rishi Mishra, an analyst at Futures First Canada.

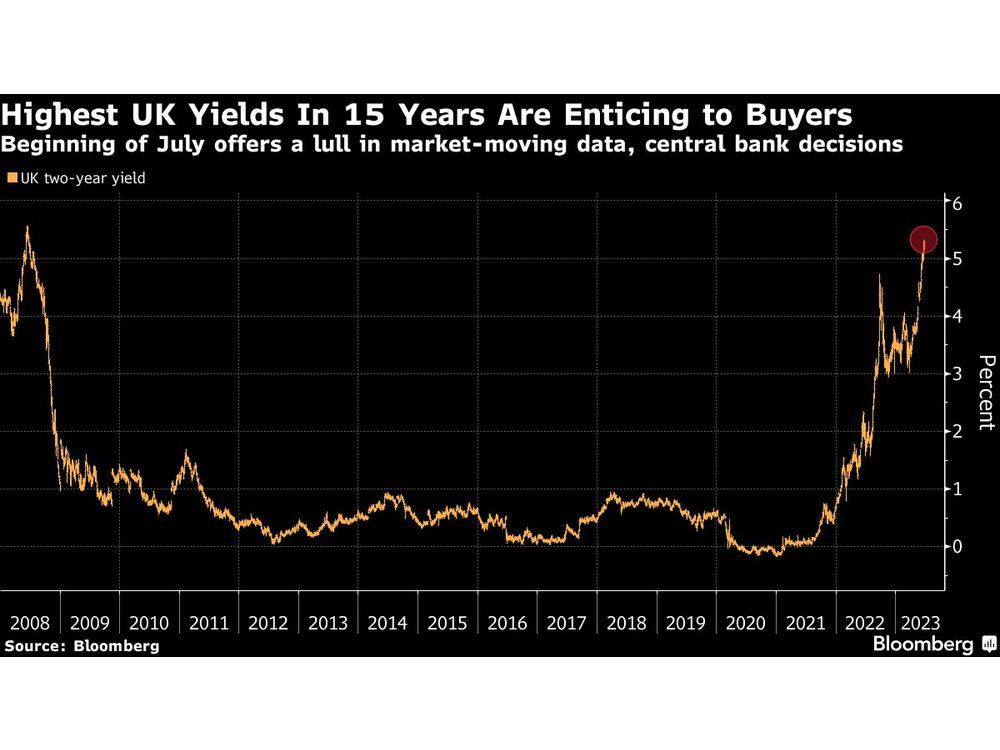

Investors have demanded ever-higher yields to hold UK bonds as inflation repeatedly makes a mockery of economists’ predictions. Recession fears are rife, with money markets showing bets for the Bank of England to deliver the highest interest rate in a quarter-century.

That’s intensified signals coming from the bond market that a contraction is coming, and the yield on shorter maturity government debt now exceeds that of longer bonds by the most in more than two decades.

But with the June inflation report more than two weeks away and strategists increasingly pointing to the fact that markets are much more hawkish than most economists’ forecasts — there’s room for a correction.

Megum Muhic, a strategist at RBC Capital Markets, says UK 10-year yields have likely hit their highest and recommends tactically owning gilts over the course of this month. “We believe that it will be difficult for the Bank to deliver on markets’ expectations,” he said.

Investors tend to buy more notes in July before summer vacations reach a peak the following month. The number of sales in August is smaller than the average for the past 12 months, data compiled by Bloomberg show.

That’s helped make July the best month for gilts every year bar one since the global financial crisis. Even last year — in the depths of the BOE’s most aggressive hiking cycle in decades — UK bonds registered returns of more than 2.8% in July.

“Buy in July while the opportunity is there,” said Aaron Rock, investment director at abrdn Plc, who says the trend is likely to continue this year. “As crazy as it might sound, it’s that simple.”

Still, the inflation fears are never far away.

Economists at Goldman Sachs Group Inc. warn of sticky services inflation and elevated wage growth. They’re forecasting another half-point rate increase at the BOE’s next policy decision in August followed by a final quarter-point increase a month later. They recently raised their year-end forecast for two-year yields to 5% from 4.4%.

But the yields are proving hard to resist for some. There are signs foreign investors were buying more in April and May, while retail buyers are also joining the fray. Interactive Investor Ltd. cited an almost tenfold jump in direct bond trading year-to-date — almost all concentrated in gilts.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation