Article content

(Bloomberg) — In a year when shorting the US dollar meant financial harakiri, carry traders’ search for an alternative currency to fund bets in emerging markets has yielded a surprise winner — the Aussie.

In a year when shorting the US dollar meant financial harakiri, carry traders’ search for an alternative currency to fund bets in emerging markets has yielded a surprise winner — the Aussie.

![rl4p)xn]05exgdm[)}ob1dj9_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2022/11/awesome-aussie-its-been-profitable-to-fund-em-carry-trades-.jpg?quality=90&strip=all&w=288&h=216)

(Bloomberg) — In a year when shorting the US dollar meant financial harakiri, carry traders’ search for an alternative currency to fund bets in emerging markets has yielded a surprise winner — the Aussie.

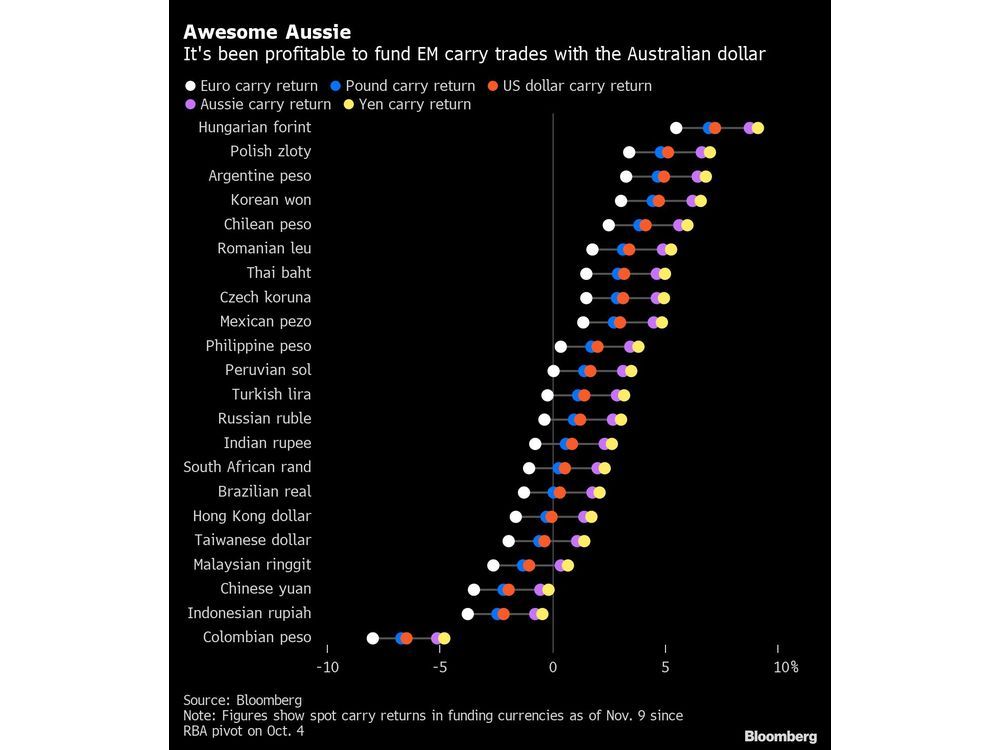

Strategies that seek to profit from interest-rate differences between higher-yielding currencies and lower-yielding ones are producing the biggest returns when funded by the Australian dollar rather than the greenback, euro or British pound and about the same as the yen, according to data compiled by Bloomberg. The outperformance comes amid a dovish tilt by Australian policymakers since early October that contrasts with the hawkish stance in the US and Europe.

While the US dollar has tumbled more than 5% from a record high in September, and is getting battered after the latest US inflation report, most money managers hesitate to call an end to its rally until the Federal Reserve halts monetary tightening. A Fed pause, however, is unlikely before the middle of next year, if money-market signals are any indication. That means market volatility will continue and the Australian dollar may well remain a funding choice for carry traders well into 2023.

“It works best in times of volatility or in a big risk-off scenario because the Australian dollar and emerging-market currencies will likely move in the same direction,” said Brendan McKenna, a strategist at Wells Fargo in New York. “Once the Fed and other central banks are accurately priced by markets, then we’ll see volatility ease.”

Emerging-market carry trades funded by the Aussie have returned an average 3.1% since the Reserve Bank of Australia slowed the pace of its hikes on Oct. 4. That’s almost double the returns from dollar-based trades in the period prior to the latest inflation report even though there were brief bursts of risk-on sentiment that kept a lid on the US currency.

Developing-nation currencies are on track for their worst annual performance against the US dollar in seven years, while the Aussie is heading for its worst year since 2018. The tandem losses have helped to keep the benchmark gauge for the local exchange rates stable against the Australian dollar.

The RBA’s policy divergence from the Fed has helped to reverse a negative correlation between emerging-market currencies and the Aussie. The relationship, based on a 30-day rolling basis, has risen to the highest since Sept. 20. This makes carry trades funded by the Australian currency a less risky proposition.

“The cost of shorting US dollars is high, and likely to climb further,” Alvin Tan, the head of Asian currency strategy at Royal Bank of Canada in Singapore. On the other hand, “the RBA’s recent pivot should cause rate differentials between the Aussie and other currencies to deviate against the AUD’s favor.”

Outshining Peers

The Australian dollar isn’t typically favored on the funding side of carry trades. It is one of the most popular targets for arbitrage traders, especially those shorting the yen. The Japanese currency, and other low yielders like the euro, are the most preferred alternatives to the dollar in a normal world. But now, the flux in the global foreign-exchange and bond markets is upending that norm.

The yen’s weakness may have already peaked as traders fear more intervention by officials to support the currency, while the euro is set to strengthen amid hawkish rhetoric from the European Central Bank. The UK pound, too, is being shunned by traders now.

“The pound became a fragile currency afflicted by outflows and a drop in confidence,” said Giuseppe Sette, the president and co-founder at Toggle AI. “That makes it a better candidate to fund emerging-market carry trades. Borrowing in pound might not prove as easy, however.”

Yet, the appeal of alternatives including the Aussie could evaporate any moment, if the dollar extends its decline. Four successive months of moderating inflation in the world’s largest economy has reduced the pressure on the Fed and revived a rally in riskier assets.

Hence, the Aussie may not replace the US dollar but act as a diversification option on the funding leg of carry trades. RBC’s Tan suggests Australian dollar-funded carry trades should be used as a hedge against volatility in a traditional portfolio. Aussie-emerging market currency pairs have thin liquidity, and investors must remain on watch for hurdles in exiting positions.

What to watch this week:

—With assistance from Colleen Goko.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door