Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Turn filing into a breeze with some essential accounting know-how

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

This article was created by StackCommerce. While Postmedia may collect a commission on sales through the links on this page, we are not being paid by the brands mentioned.

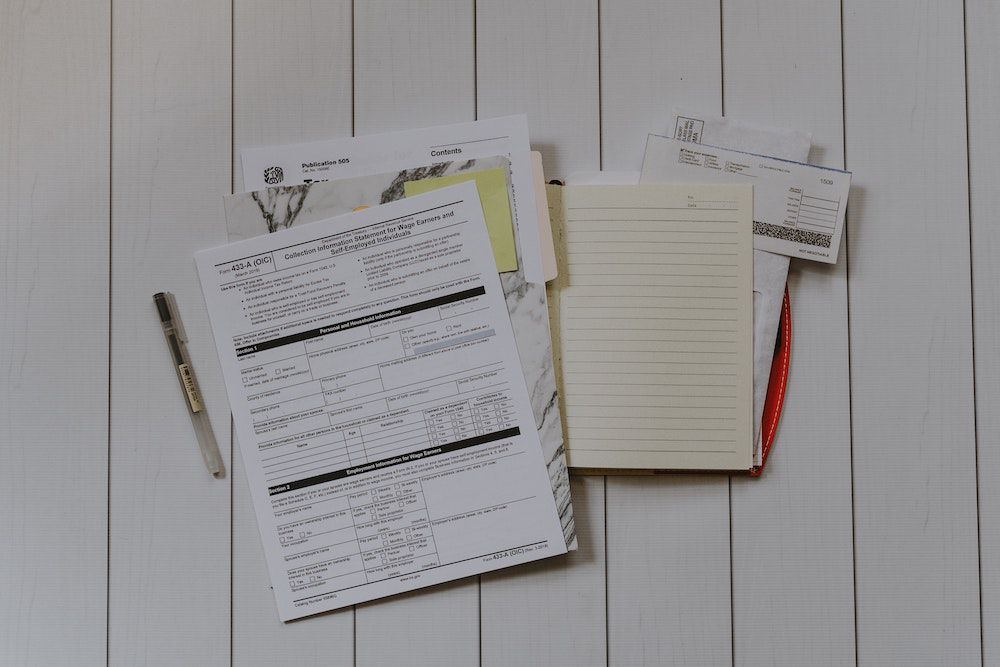

It’s official, the 2021 tax season is here, and the pandemic brings with it new tax guidelines. For starters, those who have been working from home could see a return, and anyone who collected benefits could end up owing money.

For those who had to switch to working remotely, the CRA has introduced a simplified home deduction. This is a flat-rate method that makes taxes easier to calculate. The flat-rate method allows employees to claim a tax deduction of $2 for each day they worked from home, up to a maximum of $400.

And, yes, for all of you long-time self-employed workers, the more detailed version still exists. Those of you familiar with calculating the percentage of your household expenses to apply to your business are still able to utilize this option. Choosing the right method can come down to whether you are an employee or self-employed.

This advertisement has not loaded yet, but your article continues below.

Employees can’t claim mortgage payments, which makes the flat-rate method ideal. It’s a simple calculation that takes mere minutes. If you’re self-employed, claiming things like mortgage payments, electricity, and your internet connection can make or break your business, and so the choice is a bit more complicated.As far as benefits are concerned, the government failed to withhold taxes on CERB or CESB collected in 2020, which means Canadians are in the hot seat for any outstanding amount owing.

Is it all a bit too much? Perhaps some accounting or financial training is in order. Understanding the basics of statements, debits, credits, even payroll can help you prepare for the unexpected and improve your overall outlook. Consider the 2021 Accounting Mastery Bootcamp Bundle.

With a 4.5-star rating, this program will grow and expand your knowledge base of accounting and bookkeeping so you can manage your finances with precision, in and out of tax season. Running business? No problem, you will explore all the nuances of payroll, learn business math 101, and much more.

The 2021 Accounting Mastery Bootcamp Bundle retails for over $2k and is on sale for $37.99, a discount of 98 per cent.

Prices subject to change.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door