Article content

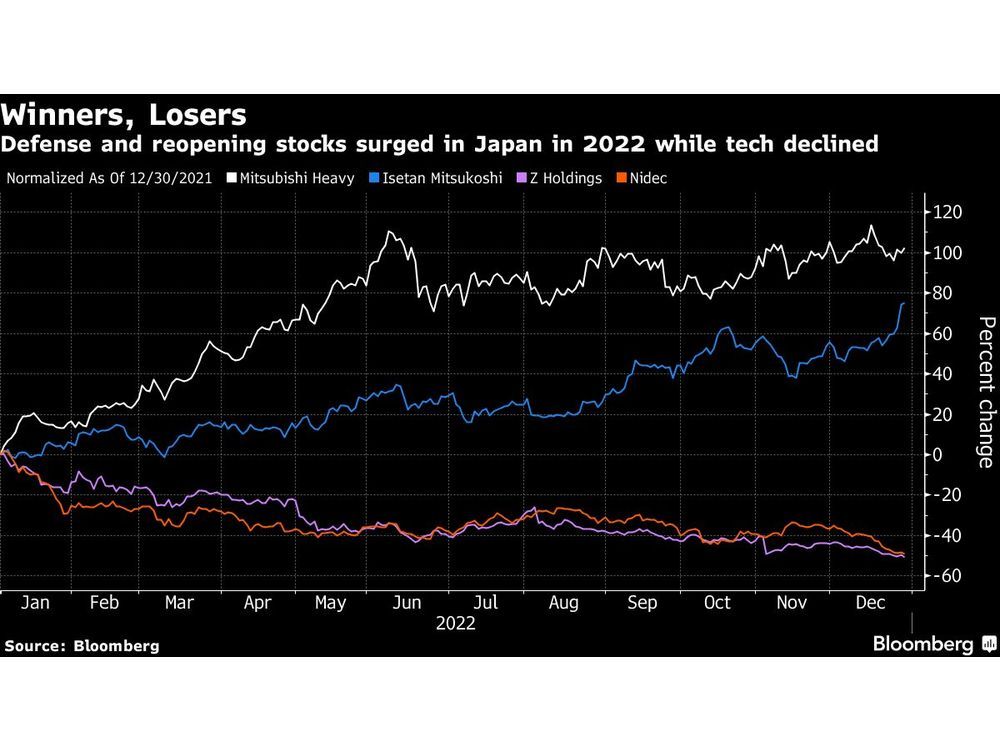

(Bloomberg) — Gains in defense and reopening stocks countered losses in technology shares to help the Japanese equity market stave off the steep declines seen in global peers this year.

(Bloomberg) — Gains in defense and reopening stocks countered losses in technology shares to help the Japanese equity market stave off the steep declines seen in global peers this year.

(Bloomberg) — Gains in defense and reopening stocks countered losses in technology shares to help the Japanese equity market stave off the steep declines seen in global peers this year.

With a sharp weakening of the yen from March into October also boosting the nation’s stocks, the benchmark Topix is only down about 4% in 2022. That’s less than a quarter the losses in the S&P 500 Index and MSCI World Index.

Internet and semiconductor stocks slid amid concerns of recession and tighter monetary policy around the world. Meanwhile defense contractors climbed amid heightened global geopolitcal tensions, and department-store operators have benefited from looser pandemic restrictions.

Most recently, banks accelerated gains following the Bank of Japan’s move to widen its bond-yield cap. While acknowledging the BOJ’s December decision is positive for financials, Citigroup Inc. maintains its view that Japanese stocks overall may see a correction going into 2023.

Investors Say BOJ Shift Dims Japan Stocks Outlook: Street Wrap

“The change in BOJ policy only reinforces this view,” strategist Ryota Sakagami wrote in a note. Exporters will be hurt by the strengthening of the yen on the central bank’s measures, while higher interest rates are negative for real estate and other sectors, he said.

Nikko Asset Management Co. sees negatives for autos and tech from the strengthening yen but notes that exporters have hedged much of their near-term currency exposure. It also sees foreign exchange helping to cool inflation.

“Overall corporate earnings face the yen headwind, but economic reopening, including in China after the first quarter, should offset most if not all of such,” chief global strategist John Vail wrote in a report.

A Bullish Case Is Building for Japan for Next Year: Taking Stock

Here’s a look at some of the most significant Japanese stock moves in 2022.

Winner: Defense

Russia’s invasion of Ukraine, ongoing tensions between China and the US, and North Korea’s repeated missile launches combined to lift defense contractors. Shares of Mitsubishi Heavy Industries Ltd. have risen 102% this year, topping gains in the Nikkei 225, with IHI Corp. (+71%) also among the top blue-chips.

Pacifist Japan Embraces Strong Military in World of Threats

Looking ahead, Goldman Sachs expects defense shares to continue to outperform given ongoing tension over Taiwan. Analyst share-price targets imply a further gain of 27% for IHI over the next 12 months.

Winner: Reopening

Airlines have been among the top-performing industry groups this year, with Japan gradually lowering Covid-related restrictions. Shares of Isetan Mitsukoshi Holdings Ltd. and Takashimaya Co., department-store chains popular with overseas visitors, have climbed more than 70% each.

The outlook is improving further with China gradually moving away from its strict Covid Zero policy. While the department stores have already exceeded current price targets, consensus sees further upside of 12% for Japan Airlines Co.

Energy and other commodities-related stocks outperformed in 2022 on hopes for economic reopening worldwide. Osaka Titanium Technologies Co. (+409%) and Toho Titanium Co. (+202%) are on course for their best year since 2005, and Jefferies sees further gains in 2023 on price hikes amid supply shortages of the material.

Winner: Banks

Mitsubishi UFJ Financial Group Inc. has climbed 44%, leading advances in Japan’s three megabanks. While current price targets indicate limited upside over the next year, the BOJ’s recent decision may not be factored in yet, and future central bank moves could provide scope for additional gains.

Loser: Stay-at-home

Z Holdings Corp. and Rakuten Group Inc. have each lost about half their value in 2022, making them the Nikkei 225’s worst performers, as emergence from the pandemic and recession fears hit e-commerce stocks. Shares of both are forecast to rise more than 60% next year.

Loser: Tech hardware

Chip-equipment maker Tokyo Electron Ltd. and Nidec Corp., the world’s biggest manufacturer of electric motors, have each shed more than 40% this year as investors shunned growth stocks on concerns over valuations amid rising interest rates.

The 20% gain analysts predict in Tokyo Electron’s stock may hinge on the outlook for the global economy as well as the standoff between Washington and Beijing over tech exports. Nidec’s 50% implied upside could hinge on major customers including Tesla Inc.

Loser: Recruitment

Shares of Recruit Holdings Co. (-39%) and other human-resources businesses suffered from a bleak outlook as global companies reduce hiring and lay off staff. The consensus view is for a 35% rebound next year in Recruit, owner of popular US job site Indeed.com.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door