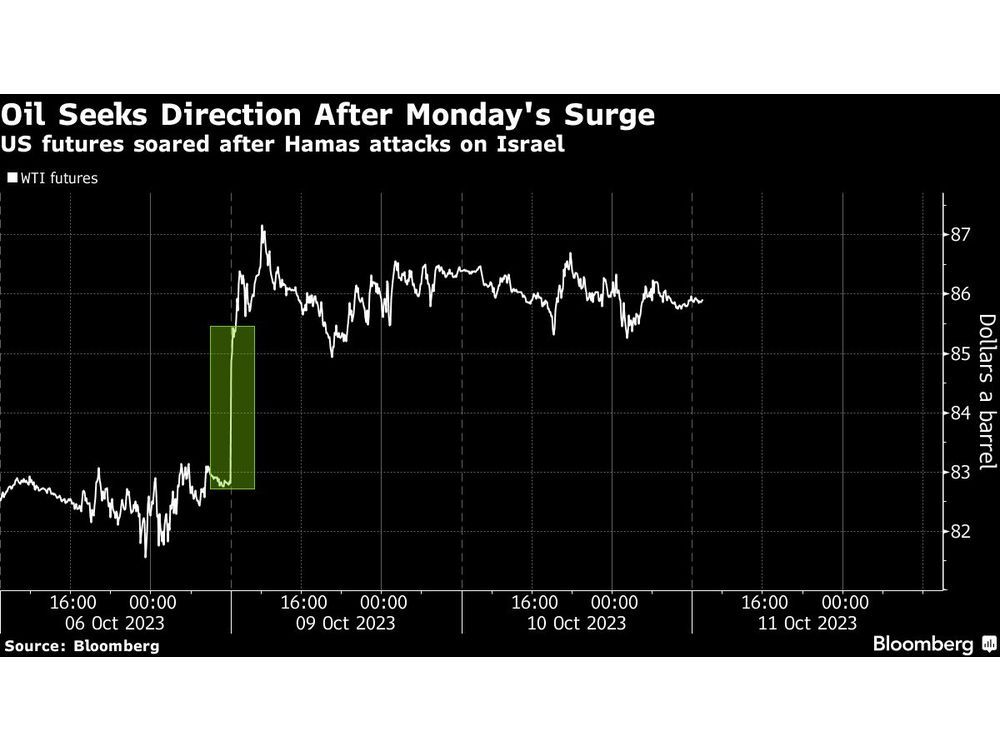

(Bloomberg) — Oil was steady in Asia — while still holding onto most of Monday’s surge — as the Israel-Hamas war remained contained and Saudi Arabia pledged to help ensure market stability.

West Texas Intermediate traded near $86 a barrel after a war-risk premium returned to the market on Monday following Hamas’ surprise attack on the weekend. The kingdom reiterated its support for efforts by OPEC+ to balance oil markets and for “everything” that would contribute to enhancing the growth of the global economy, the state-run Saudi Press Agency reported.

Article content

Almost 2,000 people have died on both sides so far in the conflict, with Israel building a base next to the Gaza Strip to accommodate tens of thousands of soldiers and the US vowing to provide the country with full support. The risk remains that the war could expand and drag in other nations in the Middle East, which accounts for about a third of the world’s crude supply.

Any proof that Iran, a supporter of Hamas, was directly involved in the attack could pose a threat to oil flows. The main risks are stricter enforcement of American sanctions on the country’s crude exports or blockades or attacks by Tehran on vessels in key shipping lanes. Iran has denied involvement and the White House said it has no confirmation that it planned or directed the assault.

“The risk of the war broadening across the regions remains the chief concern,” ANZ Group Holdings Ltd. analysts Brian Martin and Daniel Hynes said in a note. Saudi Arabia’s pledge to help OPEC+ stabilize the market, could see spare capacity released in the event that disruptions occur elsewhere, they said.

Away from the conflict, China is considering new measures to help its economy meet the country’s official growth target, which could boost demand in the biggest oil importer. An announcement could come this month, people familiar with the matter said.

The Israel-Hamas conflict has ratcheted up the volatility of oil prices, which have swung over the past month as concerns over high interest rates and slowing growth halted a rally that had been underpinned by Saudi Arabian-led output cuts. On Monday, options markets saw their biggest swing in favor of bullish calls since March 2022, shortly after Russia’s invasion of Ukraine.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Share this article in your social network

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door