Article content

(Bloomberg) — The Philippine central bank is widely expected to keep its policy rate steady for a third straight meeting after economic growth sputtered while the peso slumped and rice prices rose.

Twenty-two of 24 economists in a Bloomberg survey expect Bangko Sentral ng Pilipinas to maintain its overnight reverse repurchase rate at 6.25% on Thursday when Eli Remolona delivers his first monetary policy decision as governor. One analyst sees a quarter-point increase, and the other predicts a 12.5-basis-point hike.

Article content

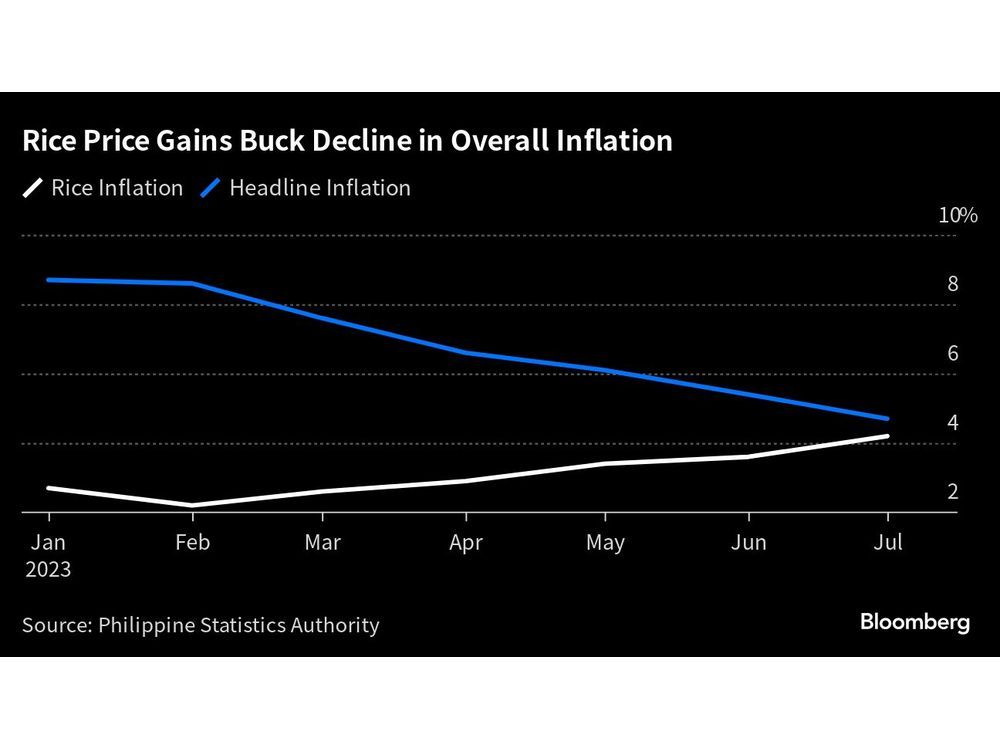

Consumer price gains that have slowed for a sixth straight month give the central bank room to maintain the status quo as it gauges whether a currency trading near a nine-month low and rising fuel and rice prices could rekindle inflation. At the same time, the BSP has to consider that growth slowed significantly amid borrowing costs at a 16-year high.

“The thought of these opposite forces might be somewhat stressful, but in reality, we think the BSP is comfortable with where monetary policy is now,” said HSBC Holdings Plc. economist Aris Dacanay.

Remolona said earlier this month, before the disappointing gross domestic product growth data, that it’s prudent for the BSP to pause while cautioning against “sudden reversals” of monetary policy. The governor, who has repeatedly signaled readiness to resume tightening amid inflation risks, this week said that a key rate above 6.8% would be “dangerous for the economy.”

Here are the key things to watch for in the decision at 3 p.m. local time:

Inflation

“Inflation will be the bigger watch factor,” said Radhika Rao, a senior economist at DBS Bank Ltd. in Singapore. “Upswings in global energy and food commodities are posing fresh risks to the trend, slowing the pace of disinflation.”

Article content

Rice, the staple grain that makes up 9% of the local consumer price basket, has been posting faster price gains in the past six months. In 2018, surging rice prices due to supply crunch stoked inflation and triggered rate hikes that year. Rice prices soared this month to the highest in almost 15 years in Asia.

The BSP expects the headline data to return to its 2%-4% target by next quarter and ease below the range in early 2024, prompting most economists in a separate survey to forecast no change in the benchmark rate until the end of this year.

Peso

The local currency became one of Asia’s worst performers in August as the rate differential with the US whittled down. The peso is also under pressure on seasonal increase in imports this quarter.

“If the currency continues to substantially weaken, the BSP may need to temporarily sacrifice supporting growth until the peso stabilizes,” said Alvin Arogo, an economist at Philippine National Bank. “Another rate hike during the remainder of 2023 still has a fair chance of happening, whereas a rate cut seems very unlikely.”

Growth

Article content

The economy posted its weakest expansion since 2011 last quarter at 4.3%. The slump in investment in the second quarter shows that the economy is starting to feel the pinch from the central bank’s 4.25 percentage points of increases since May last year, according to Bloomberg economist Tamara Mast Henderson.

“The sharp slowdown in second-quarter growth adds to the case for BSP to sustain the pause in its tightening cycle this month,” Henderson said, while keeping the door open to rate increases due to signs of a resurgence in food and fuel costs.

—With assistance from Tomoko Sato and Cynthia Li.

![i12655q)jha]tjt50fl}jph5_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/08/rice-price-gains-buck-decline-in-overall-inflation.jpg?quality=90&strip=all&w=288&h=216&sig=SWvt_PUSibBaoQEkBLsSSw)

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation