Do you want the next big thing for your portfolio? Today, if we’re to believe in one typically unexcited Wall Street bear, that could mean owning Stem (NYSE:STEM). Let’s look at what’s happening off and on the price chart, then offer a risk-adjusted determination aligned with those findings in STEM stock.

Source: petrmalinak/ShutterStock.com

Shares of STEM stock officially listed this week as sponsor Star Peak Energy finalized its reverse merger. It happened without much fanfare though. And given today’s more aware, risk-off attitude and weakened trading environment for mostly dicier SPACs, the lack of enthusiasm might superficially point to Stem being the next big thing. For bearish shorts, that is.

But seeing Stem as a short would be an excessively big mistake according to (ironically) Citron Research.

Citron. The research outfit has been one of Wall Street’s more infamous bears. Moreover, aggressive and spot-on attacks over the years against companies such as failed and scandal riddled Valeant Pharmaceuticals (now Bausch Health (NYSE:BHC)) helped make front man Andrew Left the proverbial E.F. Hutton for short sellers while putting the fear of god into bulls. When Mr. Left spoke, investors more than just listened — they ran for the exits.

But today’s Citron is decidedly different. As with many other success stories this past year during the Covid pandemic, the firm has pivoted. It’s a long-only advisor now. The firm hung up its public bearish analyst calls following a painful retreat tied to a short sale recommendation in GameStop (NYSE:GME) earlier this year.

Before you feel sorry or see payback is a “you know what” for this declawed bear, don’t. The firm pulled in 155% last year. And much of the outsized return was the result of long research in stay-at-home plays such as Zoom Video (NASDAQ:ZM) and Nautilus (NYSE:NLS). These were maybe less publicized recommendations, given a street where bullish coverage is rarely at a loss.

But don’t make that your loss with clean and AI-powered energy storage play Stem.

Today, Stem is one of Citron’s latest activist-minded recommendations with a broader, “plays nice with others” twist. And there’s massively strong reasons why Stem is a name to go long, with an eye on significant profit potential.

I’ll leave most of the devilish details to Andrew’s extensive note on STEM. But given Stem’s moat-like lead in this increasingly important space, blue-chip customers from Amazon (NASDAQ:AMZN) to Walmart (NYSE:WMT) and today’s valuation a pittance relative to its total addressable market (TAM), Stem has a lot going for it.

For investors there’s a lot to look forward to if Citron’s $100 price target bears fruit. And today, in observing the STEM stock price chart, the path to bearing fruit for investors could be set to begin today.

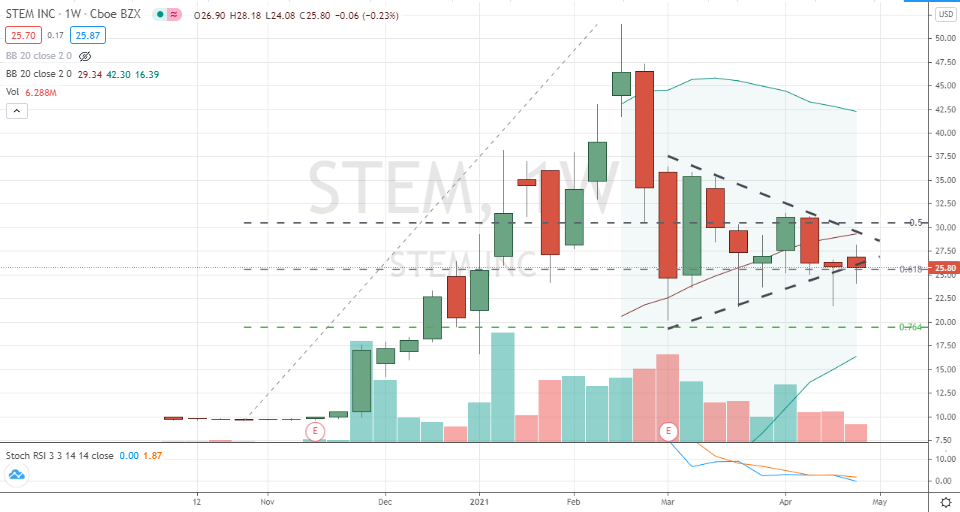

Source: Charts by TradingView

A battered and mostly bloodied SPAC environment has left STEM stock trading in a fairly common, deeper corrective cycle since topping as STPK back in February. At its worst, shares were pruned by as much as 59%.

Today though, not terribly far removed from its recent lows, STEM is shaping up as a buy that is perhaps on a path to becoming part of investing’s elite. Technically, shares have confirmed a “loose” pattern low within a symmetrical triangle. And given the background, it looks bullish.

Buying Stem shares today with a stop-loss beneath the weekly pivot is one way to approach a long position. Alternatively, waiting to buy STEM with a shift in bullish momentum can’t be faulted. A triangle breakout confirmed by a bullish stochastics crossover would pave the way for that of purchase.

Bottom line though, and as good as the story sounds the way Mr. Left explains it, I’d also recommend buying STEM stock with an options-based collar spread. At the moment, that’ll cost investors more than fair value as Stem’s market makers aren’t playing nice with others. At the end of the day though, an extra 3% to 4% to purchase a hedge and promoting the ability to accumulate smartly when others are running for the exits, still resonates strongly.

No Stocks Owned: On the date of publication, Chris Tyler does not hold, directly or indirectly, positions in any securities mentioned in this article.

Chris Tyler is a former floor-based, derivatives market maker on the American and Pacific exchanges. The information offered is based on his professional experience but strictly intended for educational purposes only. Any use of this information is 100% the responsibility of the individual. For additional market insights and related musings, follow Chris on Twitter @Options_CAT and StockTwits.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door