Article content

(Bloomberg) — Sydney recorded its highest percentage of homes selling successfully at auction in more than two years as Australians increasingly expect interest rates will fall and property-price gains quicken, according to CoreLogic Inc.

The city, a market bellwether, reported 688 auctions in the past week for a preliminary clearance rate of 81.7%, the highest reading since mid-October 2021, CoreLogic said Sunday. The 2,044 auctions nationwide was the most this year and saw demand keep up with increased supply, according to the property consultancy.

Article content

“The stronger auction results are attributable to more than early-year seasonality,” said Tim Lawless, research director at CoreLogic. “Some confidence has returned to the auction markets amid falling inflation and a growing expectation that lower interest rates later this year could see housing price growth accelerate.”

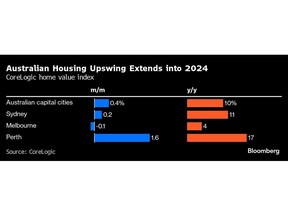

Property prices in Australia surprisingly resumed rising over the past year despite the Reserve Bank raising rates to a 12-year high of 4.35% to combat inflation. A combination of migration-driven population growth and limited supply due to spiraling construction costs have combined to defy tighter policy.

Recent data showing a slowing in inflation mean traders and economists expect the central bank’s next move will be down. Commonwealth Bank of Australia, the nation’s largest lender, predicts six cuts starting in September for a cash rate of 2.85% by June 2025. Money markets are more circumspect, pricing in two reductions over that period.

Still, how Australia deals with high building costs that are weighing on housing construction is going to be a factor in the trajectory of the property market.

Article content

Luci Ellis, chief economist at Westpac Banking Corp. and a former senior RBA official, highlighted in a research note on Friday that the prices of many building materials are still rising in Australia, even though comparable data for some other countries show declines.

She said that Canada’s surge in building costs peaked around mid-2022 and are now 2% below that level. “In contrast, home-building costs as measured in the Australian CPI have increased by around 7% over the same period.”

CoreLogic says the coming week will provide a further test of Australian housing demand, with another pick-up in auction activity as around 2,800 homes are currently scheduled to “go under the hammer.”

Share this article in your social network