Article content

(Bloomberg) — Tesla Inc.’s China deliveries are surging, along with other local electric-vehicle makers, as concerns over snarled supply chains, the lingering impact of Covid and weak consumer demand dissipate.

Tesla Inc.’s China deliveries are surging, along with other local electric-vehicle makers, as concerns over snarled supply chains, the lingering impact of Covid and weak consumer demand dissipate.

![sw5y(3so]6n}nme1ojbwzxc9_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/07/discounting-cars-in-china-dongfeng-leads-the-pack-in-slashi.jpg?quality=90&strip=all&w=288&h=216&sig=V0ddlO4Wx4Dyy23DBhSILA)

(Bloomberg) — Tesla Inc.’s China deliveries are surging, along with other local electric-vehicle makers, as concerns over snarled supply chains, the lingering impact of Covid and weak consumer demand dissipate.

Deliveries from Tesla’s Shanghai plant, which was its first outside the US, rose almost 20% from a year earlier in June to 93,680 vehicles, showing the disarray caused by a price war earlier this year is abating and interest in clean cars continues to grow in the world’s biggest EV market.

The US automaker isn’t the only EV maker to benefit from the changing conditions. While overall car sales to dealers are expected to fall 5.9% in June from a year earlier, China’s Passenger Car Association forecasts a 30% increase for new-energy vehicles.

Read more: Tesla and BYD Set the Pace With Surge in Electric-Car Sales

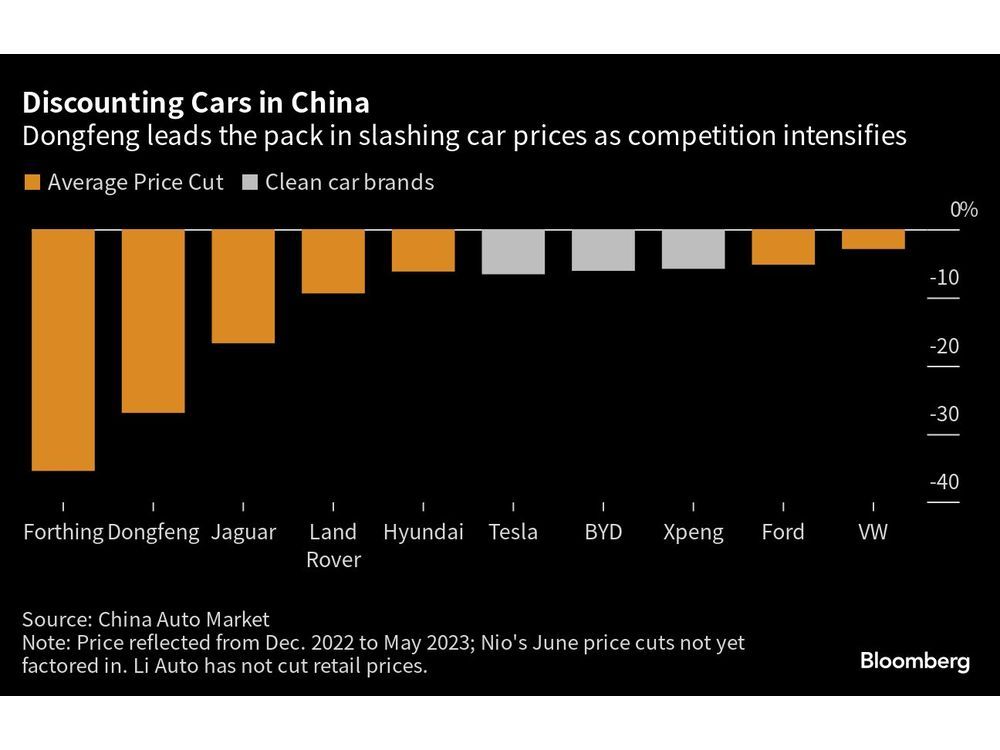

Tesla’s local rivals, which followed the EV pioneer’s aggressive price cuts, posted gains upon emerging from a chaotic period leading into the Shanghai auto show in April. BYD Co., Li Auto Inc., and Guangzhou Automobile Group Co.’s Aion all saw a rebound in June deliveries and set monthly sales records.

China’s June EV sales “surprised to the upside as demand picked up, likely signaling some normalization in consumer behavior and release of pent-up demand from buyers taking advantage of low prices,” Edison Yu, an analyst with Deutsche Bank AG, wrote in a note published Tuesday.

PCA expects NEV shipments to dealers to have risen to 740,000 in June, up from a previous forecast of 670,000 units made 10 days ago.

Demand in other markets, including Europe and North America, is also gaining momentum.

Spain’s passenger car sales increased 13.3% in June, and together with gains in countries like France and Spain contributed to an 11th straight month of expansion in Europe, according to Bloomberg Intelligence. The US new-car market is returning to pre-pandemic norms as supply-chain issues resolve, with sales likely rising to 15.6 million in June, according to forecasts from market researchers.

Tesla continued to roll out incremental incentives to spur sales in China through the spring and early summer. It offered a cash subsidy in June of 8,000 yuan ($1,100) to some buyers of its Model 3 sedans who bought designated insurance coverage and took delivery quickly. Preferential low interest rates for some car loans were also provided.

The base version of its Model 3 in China now stands at the equivalent of about $32,000, while the Model Y is $36,440. In the US, they cost $40,240 and $47,740, respectively, before discounts such as a $7,500 tax credit.

Chinese consumers may have grown more comfortable with the idea of buying a Tesla after Elon Musk visited the country in May and met with officials.

After a red-carpet welcome when the company first arrived in China, Tesla has at times weathered public criticism as tension built between Washington and Beijing. Angry Tesla owners swarmed showrooms in January to complain about missing price cuts. The company’s cars were also banned from Chinese military complexes and housing compounds in early 2021 over concerns that sensitive data was being collected by cameras built into the vehicles. And an expansion of the Shanghai plant was delayed.

China is dedicated to opening up and creating a better business environment for multinational companies, including Tesla, Foreign Minister Qin Gang said during his meeting with Musk in Beijing earlier this year. Musk reassured the government that Tesla is against the idea of “decoupling” between the US and China, and is willing to keep expanding its businesses in the country.

Tesla’s Shanghai manufacturing hub is key for the automaker, producing over 710,000 cars in 2022, representing more than half of the company’s global output. The plant has the capability to make 1.1 million EVs a year and is preparing to produce a revamped Model 3 sedan, which was Tesla’s first mass-made EV, to better compete against increasingly powerful Chinese competitors.

In a broad boost for the EV industry, Chinese authorities last month announced an extension of tax breaks for consumers buying clean cars through 2027. The government also started a campaign to encourage EV adoption in rural areas.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation