Players in the multiline insurance space are gaining from the ongoing rapid economic recovery. Increased vaccinations around the world are helping in streamlining the impact of the pandemic from the economies. The favorable backdrop is encouraging for multiline insurers, which are significantly leaning on product diversification to ensure uninterrupted revenue generation, increase the retention ratio and reduce concentration risk. The advancement of digitization is further boosting opportunities for the players, with operations becoming easy and smooth.

– Zacks

Improved pricing in 2022 is expected to support premium growth going forward. Even though the new virus variants concern some analysts, the growing awareness of the pandemic and revamped medical infrastructure are expected to benefit life insurance businesses by reducing claim payments. MetLife Inc. MET and American International Group AIG are both poised to gain from this.

Though the continued lower interest rate environment is likely to strain the companies’ net investment income, the well-performing equity market is expected to lead to increased alternative investment returns. Also, securing additional capital will be cheaper. The overall bullish outlook can trigger the growth of this industry, which should boost the prospects of the companies with strong business fundamentals.

Now let’s take a look at the two leading players in the industry: MET & AIG.

Both the stocks currently have a Zacks Rank #3 (Hold) and a VGM Score of B. Our research shows that stocks with a VGM Score of A or B combined with a Zacks Rank #1 (Strong Buy) or 2 (Buy) or 3 offer the best investment opportunities. You can see the complete list of today’s Zacks #1 Rank stocks here.

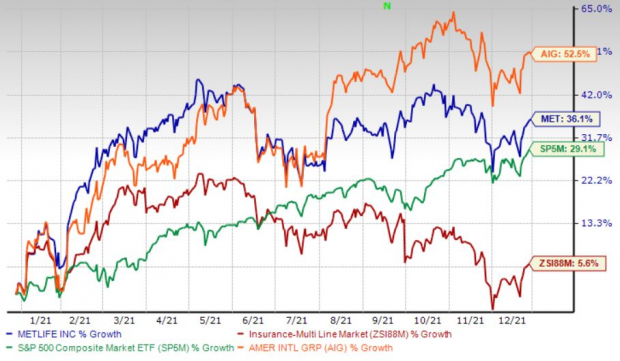

In terms of price performance, American International is a clear winner. American International has gained 52.5% over the past year, outperforming the broader industry’s 5.6% growth. In comparison, MetLife has gained 36.1% over the same period. The S&P 500 Index has rallied 29.1% in the same time frame.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

A stock’s earnings surprise helps investors get an idea about its performance in the previous quarters.

In the last reported quarter, MetLife recorded adjusted operating earnings of $2.39 per share, which surpassed the Zacks Consensus Estimate by 44%, thanks to solid contributions from EMEA, Asia and MetLife Holdings. American International’s third-quarter 2021 adjusted operating earnings of 97 cents per share surpassed the Zacks Consensus Estimate by 4.3% on solid contribution from the General Insurance segment.

Considering a more comprehensive earnings history, MetLife’s bottom line managed to beat estimates in each of the trailing four quarters, with the average being 43.1%. In comparison, American International beat earnings estimates thrice and missed once, with the average surprise being 8.5%. Here, MetLife has an edge over American International.

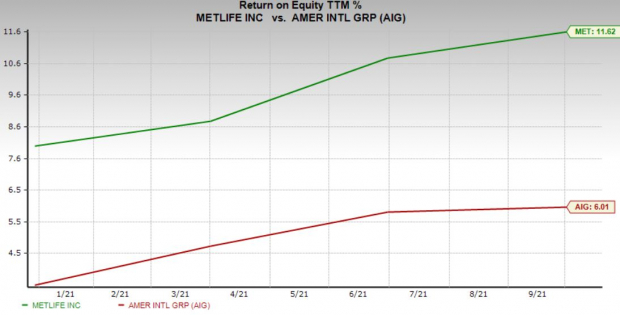

Return on equity is a significant profitability measure, which accounts for profits generated on shareholders’ equity. Hence, higher ROE reflects the company’s efficiency in using shareholders’ funds and is preferred by all equity investors.

MET’s ROE of 11.6% in the trailing 12-month period compares favorably with AIG’s 6%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Now let’s look at the companies’ free cash flows from operations, an important gauge of financial health.

MetLife generated a free cash flow of $12,409 million in the trailing 12-month period, which witnessed a 6.6% increase. The company expects to generate $20 billion of free cash flow over the five-year period from 2020 through 2024.

American International didn’t perform too badly either, generating a free cash flow of $4,570 million during the same time period. Although it is taking strategic initiatives to boost cash flow generating abilities from operations, AIG might take some time to reach MET’s level.

MET and AIG are two of the best-run companies among the global players, consistently producing industry-leading financial returns. They remain in sound financial health, with enough cash on hand and a very manageable debt-to-capitalization ratio. Yet, MetLife’s debt to capitalization of 17.6% is well below the industry average of 28.1%, with American International at a higher level of 32.5%.

The price-to-earnings value is one of the most important multiples used for valuing multiline insurers. Comparing favorably with the industry’s forward 12-month P/E ratio of 10.6, MET and AIG has a reading of 8.6 and 10.4, respectively. MetLife has a better reading than American International.

Our comparative analysis shows that MetLife holds an edge over American International in terms of valuation, balance sheet strength, free cash flow generation (partly due to its larger size), ROE and earnings surprise history. Nonetheless, AIG stock has gained more in the past year. As the scale is well tilted toward MetLife, the stock can make a more promising investment proposition.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG): Free Stock Analysis Report

MetLife, Inc. (MET): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

A Brief Look at the History of Telematics and Vehicles

Tips for Helping Your Students Learn More Efficiently

How To Diagnose Common Diesel Engine Problems Like a Pro

4 Common Myths About Wildland Firefighting Debunked

Is It Possible To Modernize Off-Grid Living?

4 Advantages of Owning Your Own Dump Truck

5 Characteristics of Truth and Consequences in NM

How To Make Your Wedding More Accessible

Ensure Large-Format Printing Success With These Tips

4 Reasons To Consider an Artificial Lawn

The Importance of Industrial Bearings in Manufacturing

5 Tips for Getting Your First Product Out the Door